|

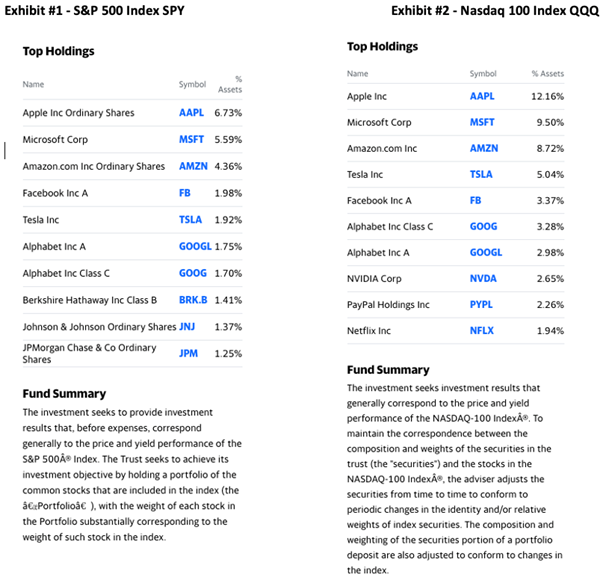

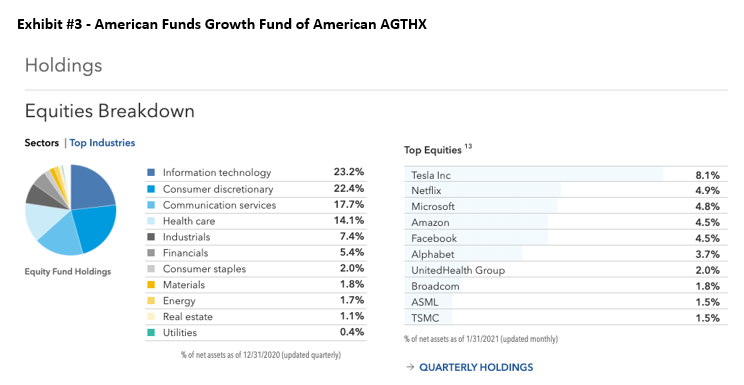

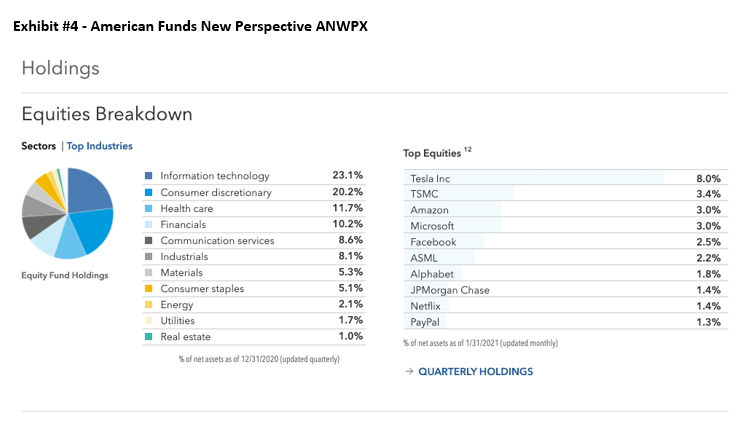

Over the past few years, technology stocks have outperformed other broad market indices. This is due to a number of reasons, one being the decline of interest rates, as we’ve discussed in prior articles. Low interest rates tend to increase interest in growth stocks over value-oriented stocks. One thing to note is that could eventually change if interest rates were to begin to rise over time back to normalized levels, and especially if the Federal Reserve were to increase rates in the future. See my book chapter 5 on the bond market. With that said, one item of interest to note is the correlation between the index funds, mutual funds, and the “market weighted” S&P 500 Index. What do I mean by “market weighted”? The S&P 500 Index that we all see on CNBC or The Nightly News is an index that invests a percentage of its holdings in each of the 500 companies based on their market capitalization (the value of the company). A heavier weighting is assigned to stocks with higher value. See Exhibit #1. Just over 24% of the value of the index is invested in six companies that are in the technology sector. Exhibit #2 lists the Nasdaq 100 stocks, and the top stocks are nearly a mirror image of the S&P 500 Index, weightings slightly different, but the same companies listed at the top. What does this all mean? First off, the S&P 500 index has benefited over the past several years from the growth of the top technology stocks like Apple, Google, Microsoft and Amazon. We would think that the performance has been slightly skewed with a nearly 24% allocation to so few stocks in one sector. Then of course we have some of the top performing mutual funds that also invest a large portion of their portfolio to these stocks. After all, a mutual fund’s performance needs to keep up with the index in order for individual investors to use their fund or fund family. American Funds, for instance, are used by many of the well-known financial companies that invest for individual investors and 401k plans. This is simply an example to show how first, you can overlap holdings just by simply buying two mutual funds from the same family of funds. Second, you may own many of the same holdings if you own other fund families as well, including the S&P 500 Index Fund offered by Vanguard. It’s important to dissect your stock holdings within the mutual fund or other financial products in order to make sure you aren’t just duplicating holdings. See Exhibits #3 and #4. What do you do if you’re unsure about having too much exposure to technology stocks or just would like to know if you’re diversified enough? It’s always a good idea to understand your portfolio, to know whether you’ve leaned too much in a certain sector. Should technology stocks become out of favor over the coming years due to a change in the investing landscape, or just need to rest for a while, many of the mutual funds that have done very well may suffer.

It’s wise to take the opportunity while the subject is on your mind and get a second opinion. Whether with us or someone else, it’s wise not to take for granted changes in the investing environment. When investors change their mindset, what once worked for many years can change quickly. The pendulum can swing and take years to get back to equilibrium. Sometimes investors that have stuck with a certain mutual fund for years cannot understand why it no longer delivers the returns they were accustomed to. This can be due to individual holdings, as we’ve discovered, or due to the fund owning bonds in addition to stocks, and the bond market loses at the same time the stock market loses. Not something investors have been accustomed to in a very long time. Another mistake that is often made with investors is they look for last year’s winners and buy them, as they believe that win streak will continue. That can certainly work some of the time, but it’s not an investment plan of action that should be counted on to work consistently. Everything stated above is meant to bring to light that there is a need to look under the hood of your portfolio holdings. Just having a list of mutual funds on your statement does not necessarily mean you’re diversified, or that those funds are not highly correlated. Please take the time to analyze your portfolio. We’d be happy to start with a no-obligation “strategy session.” Send me an email or phone call. You can also schedule time on my calendar by clicking here. If you would like to read my book, The Informed Retiree, visit my website www.TheInformedRetiree.com or send me an email to [email protected] Also available on Amazon.com Advisory services offered through J.W. Cole Advisors, Inc. (JWCA). Global Wealth Solutions and JWCA are unaffiliated entities

0 Comments

|

AuthorWrite something about yourself. No need to be fancy, just an overview. Archives

November 2022

Categories |

Advisory services offered through J.W. Cole Advisors, Inc. (JWCA). Global Wealth Solutions, LLC. and JWCA are unaffiliated entities.

For a copy of JWCA’s Form CRS or JWCA’s disclosure Supplement, please click Here. By following the link, you consent to receipt of the Form CRS electronically.

For a copy of JWC's Disclosure Supplement please visit https://www.jw-cole/disclosures

Check the background of an investment professional. | Len Rhoades ADV Part 2B

Licensed Insurance Professional. Respond and learn how life insurance and annuities can be used in various planning strategies for retirement.

17453 - 2018/3/9

For a copy of JWCA’s Form CRS or JWCA’s disclosure Supplement, please click Here. By following the link, you consent to receipt of the Form CRS electronically.

For a copy of JWC's Disclosure Supplement please visit https://www.jw-cole/disclosures

Check the background of an investment professional. | Len Rhoades ADV Part 2B

Licensed Insurance Professional. Respond and learn how life insurance and annuities can be used in various planning strategies for retirement.

17453 - 2018/3/9

RSS Feed

RSS Feed