|

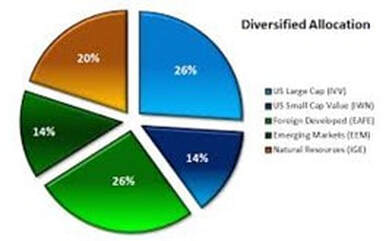

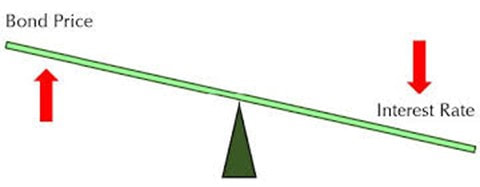

Over the years, I have had the conversation with many pre-retirees who ask the question, “What do I need to do to retire early?” The answer is not just one thing will do; it takes a series of strategic moves to be comfortable with the decision. Why do we say this? People are living longer than they did in the past, which means our money and income needs to last as well. In addition, we have a good chance of using a portion of our assets towards assisted living or nursing care. We could save a large nest egg, only to experience a sideways or declining market drop, one similar to 2000-2009. When we retire, as it relates to stock market, valuations and interest rate levels can also have an effect. How our portfolio is diversified and if we have a steady stream of income not dependent on the stock or bond markets is yet another factor. These and many more questions will be discussed in the series, “Would you like to retire early?” We will begin with the topic of diversification. Many of the name brand firms in the financial services industry use diversification to assist in reducing volatility and proving an overall total return. Harry Markowitz in the 1950s pioneered modern portfolio theory1. The idea of dividing a portfolio into a basket of different size companies with differing objectives, international, real estate, commodities, and bonds, was a way to reduce overall risk. Many of the firms on Wall Street still utilize this approach. At first glance, it still seems to make good sense; however, there are, in my opinion, a few flaws that could be improved upon. One of the biggest flaws I currently see is the portion allocated to bonds. Over the past 40 years, interest rates have fallen from the high teens to sub 1% in the 10-year Treasury2. If you do not understand how interest rates work, think of a teeter-totter. As rates fall, think one side of the teeter-totter, the other side goes up, which in this illustration, is the price of the bond. Simply put, interest rates have fallen to levels never seen in the history of the bond market, and as such, the value of the bonds have risen accordingly. If you would like to learn more, read chapter 5 of my book, “The Informed Retiree.” It can be found at www.TheInformedRetiree.com. With that said, bonds just do not provide enough horsepower any longer to enhance total return for a portfolio, nor do they provide enough of a cushion to offset stock declines for more conservative investors. So, all in all, the once powerful diversification into bonds may have run its course, and thus lost its luster. However, it could be worse than we might expect. What if rates actually began to rise over the coming years? What would happen? Think of the teeter-totter illustration again. If rates rise rather than fall, as they have for decades, then the opposite happens, price of the bond loses value.

This phenomenon would have a bigger impact on bond mutual funds than individual bonds. Why? Individual bonds eventually have a maturity date; thus, the investor receives their investment back as long as the company fulfills its obligation. Yet mutual funds do not have a maturity date; they are a perpetual investment, and thus continue to follow the trend of underlying interest rates - and here is the point - whether they go up or down3. Understand, not all bonds are equally affected by interest rates. There are other factors that may affect the value of a bond beyond just interest rates alone. However, for the most part, interest rates drive much of the underlying performance of the bond market. What are investors to do? Look for future articles in this series to read about the potential solutions to the problem that could exist for many years. If you would like to read my book, The Informed Retiree, visit my website www.TheInformedRetiree.com or send me an email to [email protected] Also available on Amazon.com Advisory services offered through J.W. Cole Advisors, Inc. (JWCA). Global Wealth Solutions and JWCA are unaffiliated entities

0 Comments

Leave a Reply. |

AuthorWrite something about yourself. No need to be fancy, just an overview. Archives

November 2022

Categories |

Advisory services offered through J.W. Cole Advisors, Inc. (JWCA). Global Wealth Solutions, LLC. and JWCA are unaffiliated entities.

For a copy of JWCA’s Form CRS or JWCA’s disclosure Supplement, please click Here. By following the link, you consent to receipt of the Form CRS electronically.

For a copy of JWC's Disclosure Supplement please visit https://www.jw-cole/disclosures

Check the background of an investment professional. | Len Rhoades ADV Part 2B

Licensed Insurance Professional. Respond and learn how life insurance and annuities can be used in various planning strategies for retirement.

17453 - 2018/3/9

For a copy of JWCA’s Form CRS or JWCA’s disclosure Supplement, please click Here. By following the link, you consent to receipt of the Form CRS electronically.

For a copy of JWC's Disclosure Supplement please visit https://www.jw-cole/disclosures

Check the background of an investment professional. | Len Rhoades ADV Part 2B

Licensed Insurance Professional. Respond and learn how life insurance and annuities can be used in various planning strategies for retirement.

17453 - 2018/3/9

RSS Feed

RSS Feed